Your Overview to Medicare Supplement Plans Near Me

Your Overview to Medicare Supplement Plans Near Me

Blog Article

Discover the most effective Medicare Supplement Program for Your Insurance Policy Demands

In the world of health care insurance coverage, the mission for the optimal Medicare supplement plan tailored to one's specific requirements can typically appear like browsing a maze of choices and factors to consider (Medicare Supplement plans near me). With the intricacy of the healthcare system and the array of offered strategies, it is important to come close to the decision-making process with a detailed understanding and calculated attitude. As individuals start this trip to secure the ideal protection for their insurance policy needs, there are key factors to ponder, comparisons to be made, and expert suggestions to uncover - all important aspects in the quest for the optimum Medicare supplement plan

Recognizing Medicare Supplement Program

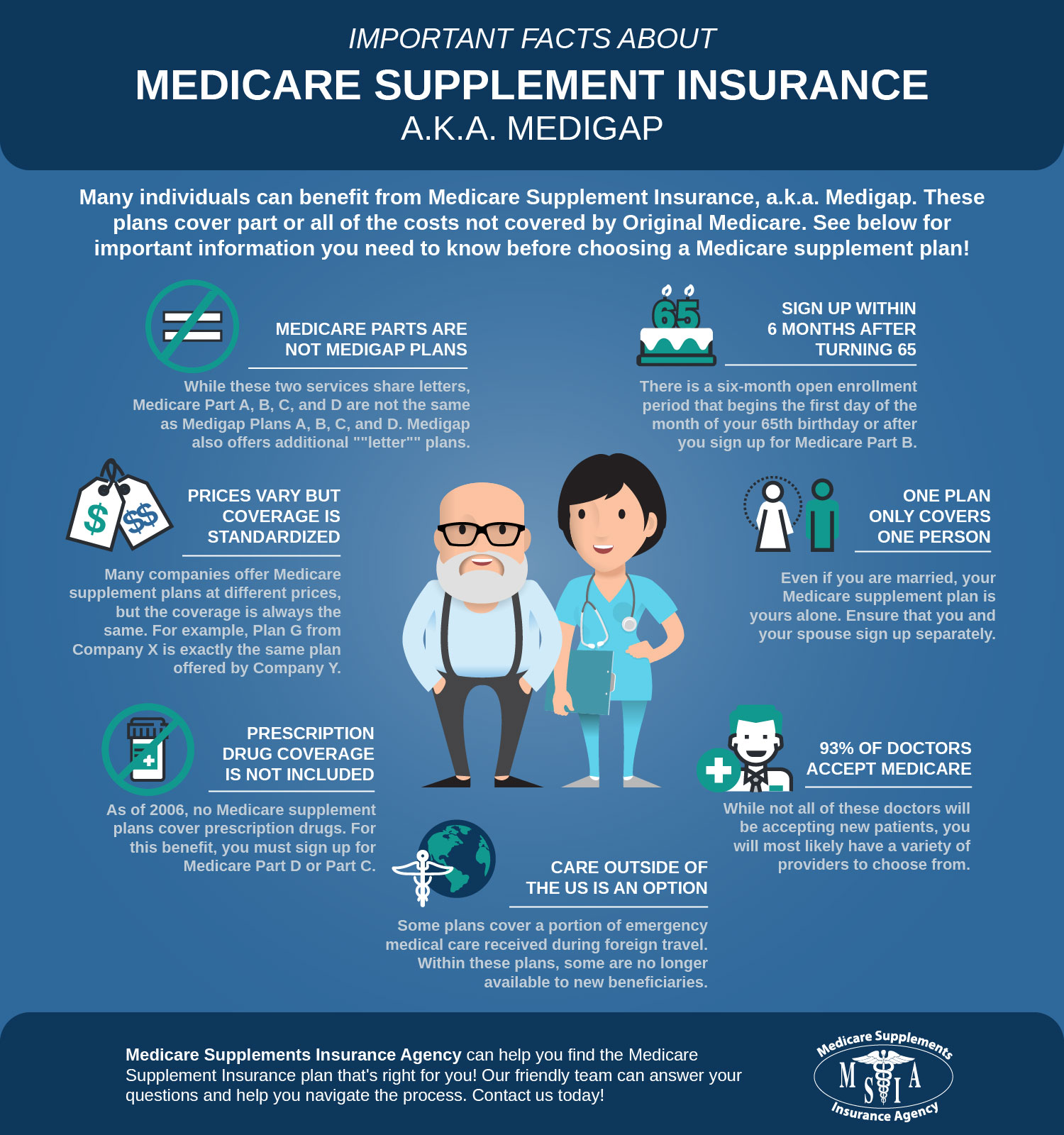

Understanding Medicare Supplement Program is important for people seeking added coverage past what initial Medicare offers. These strategies, also called Medigap policies, are used by exclusive insurance provider to assist spend for health care prices that original Medicare does not cover, such as copayments, coinsurance, and deductibles. It's crucial to note that Medicare Supplement Program can only be bought if you already have Medicare Part A and Component B.

One key element of understanding these plans is understanding that there are various standardized Medigap plans readily available in many states, classified A with N, each supplying a different collection of fundamental advantages. For example, Strategy F is one of one of the most extensive plans, covering mostly all out-of-pocket expenses that Medicare does not pay. On the various other hand, Plan A gives fewer advantages but might include a lower costs.

To make an informed decision about which Medicare Supplement Plan is best for you, it is essential to consider your medical care requires, spending plan, and insurance coverage preferences. Consulting with a certified insurance agent or checking out on-line sources can help you browse the intricacies of Medicare Supplement Program and pick the most effective alternative for your specific conditions.

Variables to Think About When Selecting

Having a clear understanding of your health care needs and monetary capabilities is vital when thinking about which Medicare Supplement Strategy to select. Consider variables such as prescription drug insurance coverage, physician brows through, and any type of possible surgical treatments or therapies.

One more vital element to take into consideration is the plan's protection alternatives. Different Medicare Supplement Program deal varying levels of insurance coverage, so make sure the strategy you pick aligns with your certain medical care requirements. Furthermore, take into consideration the credibility and economic security of the insurance provider supplying the strategy. You intend to pick a copyright that has a strong track document of customer fulfillment and prompt cases processing.

Comparing Various Strategy Options

When evaluating Medicare Supplement Plans, it is important to contrast the different plan choices offered to figure out the most effective suitable for your health care requirements and monetary circumstance. To start, it is vital to comprehend that Medicare Supplement Strategies are standardized across many states, with each plan labeled by a letter (A-N) and offering different levels of coverage. By contrasting these plans, people can analyze the insurance coverage supplied by each plan and select the one that best meets their specific needs.

When comparing various strategy alternatives, it is important to think about aspects such as monthly premiums, out-of-pocket costs, insurance coverage advantages, copyright networks, and consumer satisfaction rankings. Some strategies may offer more extensive coverage yet included greater regular monthly costs, while others might have reduced premiums but fewer advantages. By assessing these elements and weighing them versus your health care needs and spending plan, you can make an informed choice on which Medicare Supplement Strategy offers the a lot of value for your specific scenarios.

Tips for Finding the Right Insurance Coverage

Next, study the offered Medicare Supplement Plans in your location. Comprehend the coverage given by each plan, including deductibles, copayments, and coinsurance. Contrast the benefits supplied by different plans to figure out which lines up ideal with your health care priorities.

Consult from read what he said insurance representatives or brokers focusing on Medicare plans - Medicare Supplement plans near me. These experts can offer beneficial insights right into the nuances of each strategy and assist you in picking the most proper coverage based upon your individual scenarios

Lastly, testimonial client responses and scores for Medicare Supplement Program to gauge general satisfaction degrees and identify any type of reoccuring issues or worries. Utilizing these pointers will certainly aid you browse the complex landscape of Medicare Supplement Program and locate the insurance coverage that finest fits your demands.

How to Register in a Medicare Supplement Strategy

Enlisting in a Medicare Supplement Strategy entails an uncomplicated procedure that needs mindful factor to consider and documentation. The initial action is to guarantee qualification by being signed up in Medicare Part A and Component B. As soon as eligibility is confirmed, the next action is to research and compare the offered Medicare Supplement Program to find the one that ideal fits your healthcare requirements and budget.

To register in a Medicare Supplement Strategy, you can do so during the Medigap Open Registration Period, which begins the very first month you're 65 or older and registered in Medicare Part B. Throughout this period, you have ensured problem legal rights, indicating that insurer can not deny you coverage or charge you greater costs based upon pre-existing problems.

To enlist, just call the insurance provider using the preferred plan and complete the necessary documentation. It's important to review all terms prior to registering to ensure you comprehend the protection offered. Once enrolled, you can appreciate the included benefits and peace of mind that feature having a Medicare Supplement Strategy.

Final Thought

In conclusion, picking the most effective Medicare supplement plan requires mindful factor to consider of elements such as coverage alternatives, expenses, and company networks. By visit homepage comparing various plan options and reviewing specific insurance demands, individuals can discover one of the most appropriate protection for their healthcare requirements. It is necessary to register in a Medicare supplement plan that provides thorough advantages and monetary security to guarantee comfort in managing health care expenditures.

Report this page